SAP FICO Module – Complete Finance Module Overview

Learn SAP Financial Accounting (FI) with real-time access, expert guidance, and placement support at Think Tree.

Grade a+ Course

Content is Benchmarked by SAP

Trained 10k+ Students

10000+ candidates are trained from our Institute in the last 10 years.

We are based in New Jersey, USA

26 Wills Way, Piscataway, NJ, USA 08854

4.8+ rating

Highly satisfied students

We are based in New Jersey, USA

26 Wills Way, Piscataway, NJ, USA 08854

Level 3 – Expert Level Course

Course is designed to prepare you to become a SAP Consultant

Trained 10k+ Students

10000+ candidates are trained from our Institute in the last 10 years.

4.8+ rating

Highly satisfied students

What is SAP FICO Module – Complete Finance Module Overview

What is SAP Finance Module

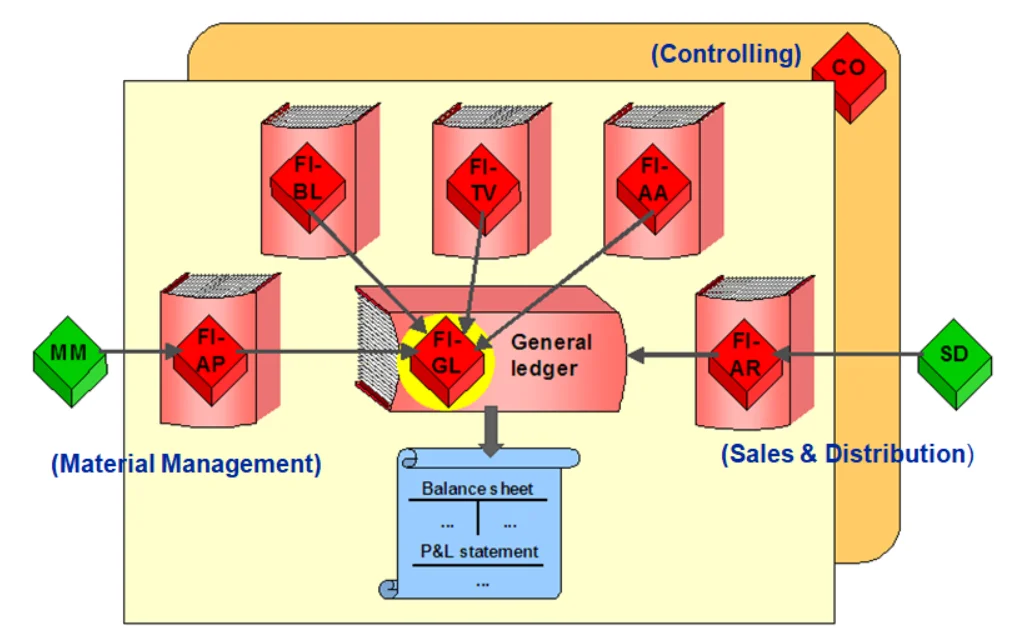

The Finance (FI) module in SAP is a core component of the SAP ERP system that helps businesses manage all their financial transactions, accounting data, and external reporting requirements in a centralized and reliable way.

Key Functions of SAP FI:

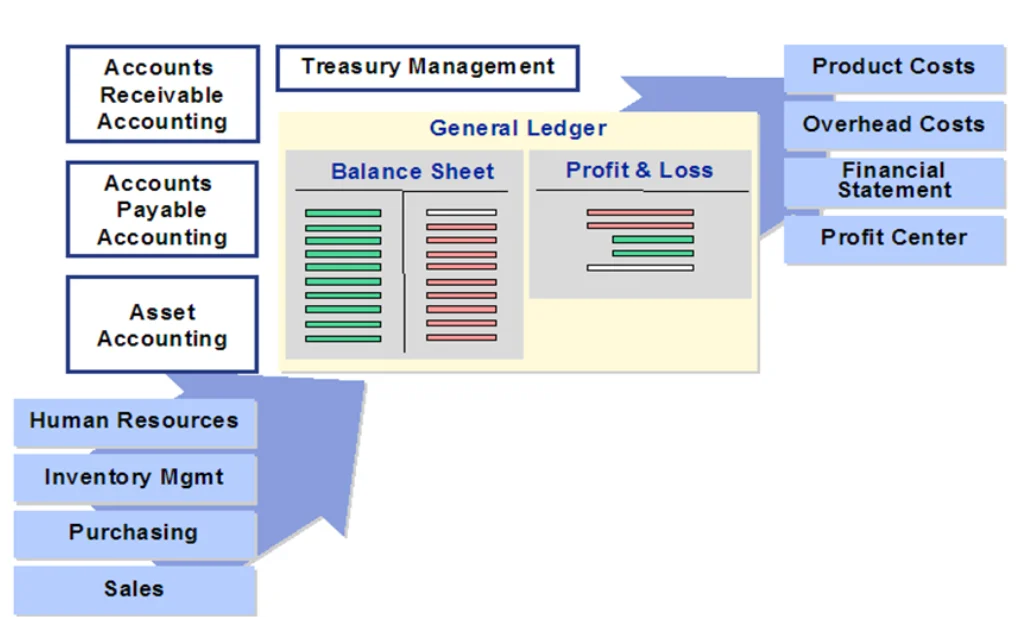

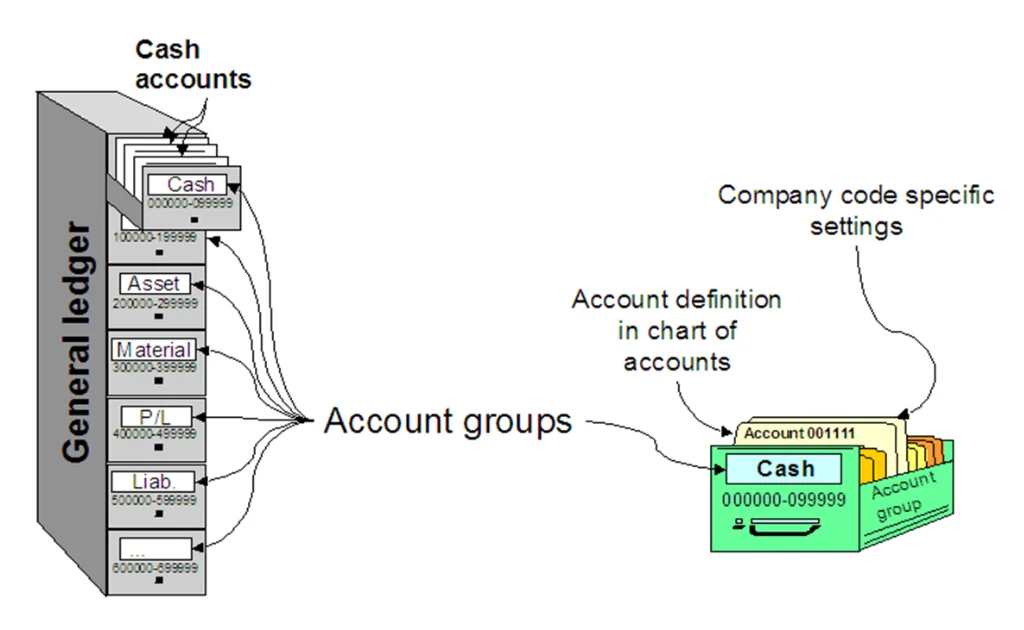

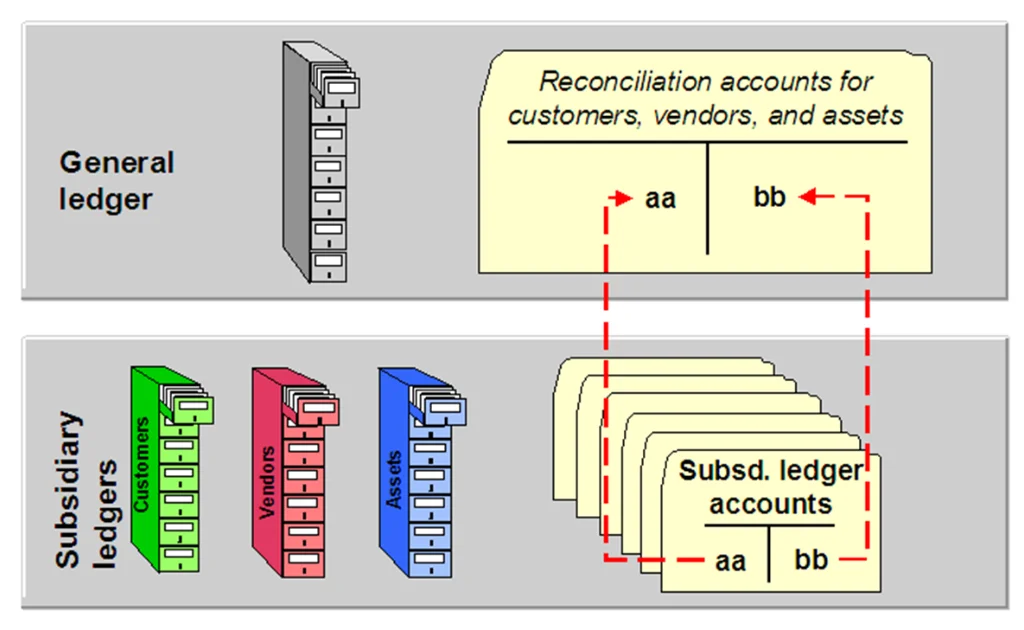

- General Ledger (GL):

- Records all business transactions in real time—income, expenses, assets, and liabilities.

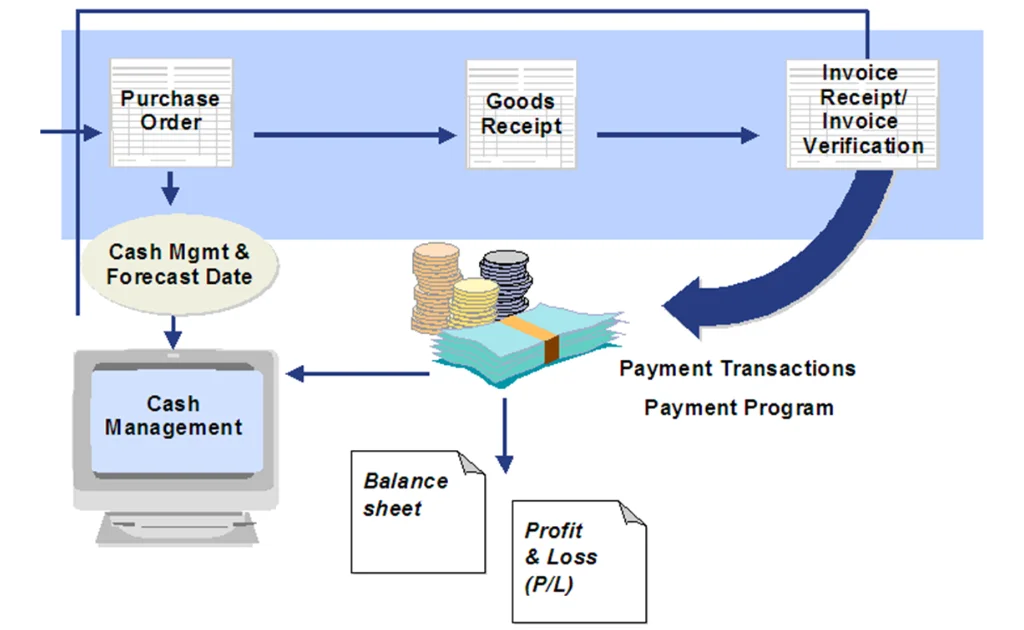

- Accounts Payable (AP):

- Manages vendor invoices, payments, and credits.

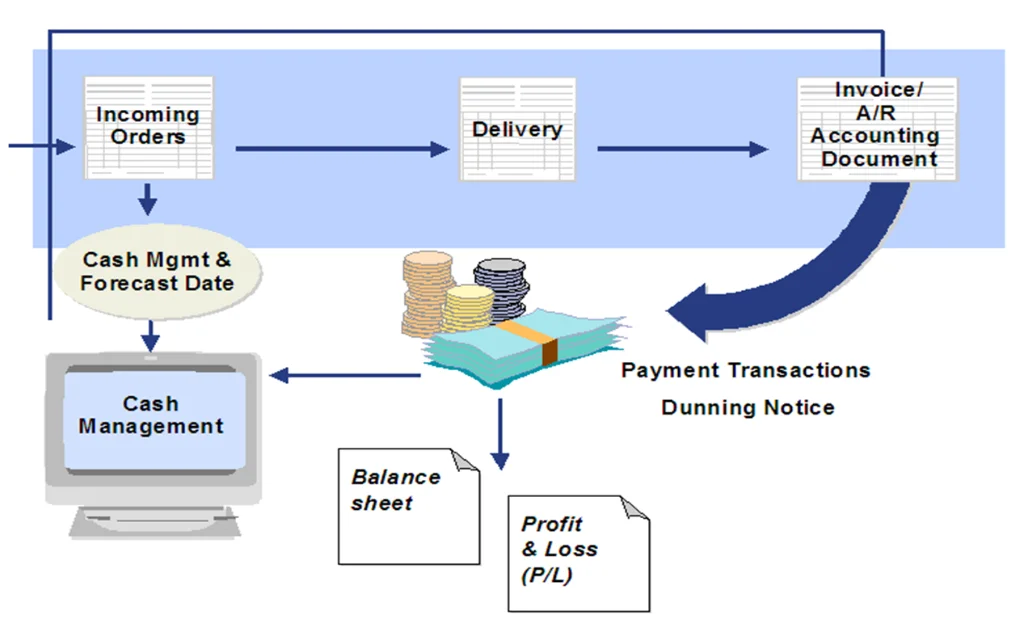

- Accounts Receivable (AR):

- Tracks customer invoices, incoming payments, and credit limits.

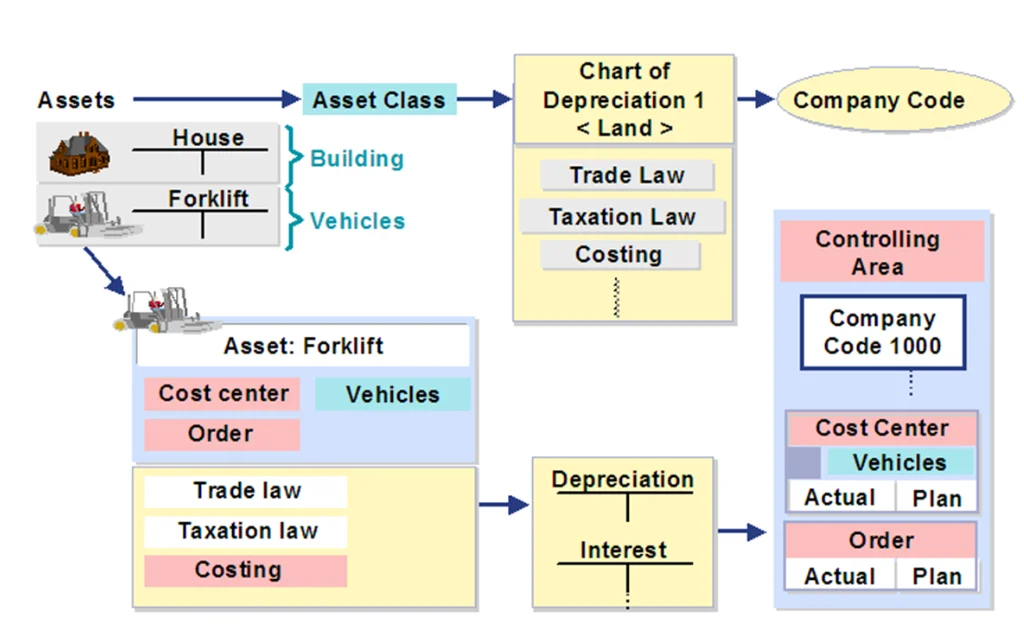

- Asset Accounting (AA):

- Handles the complete lifecycle of fixed assets—from purchase to depreciation and retirement.

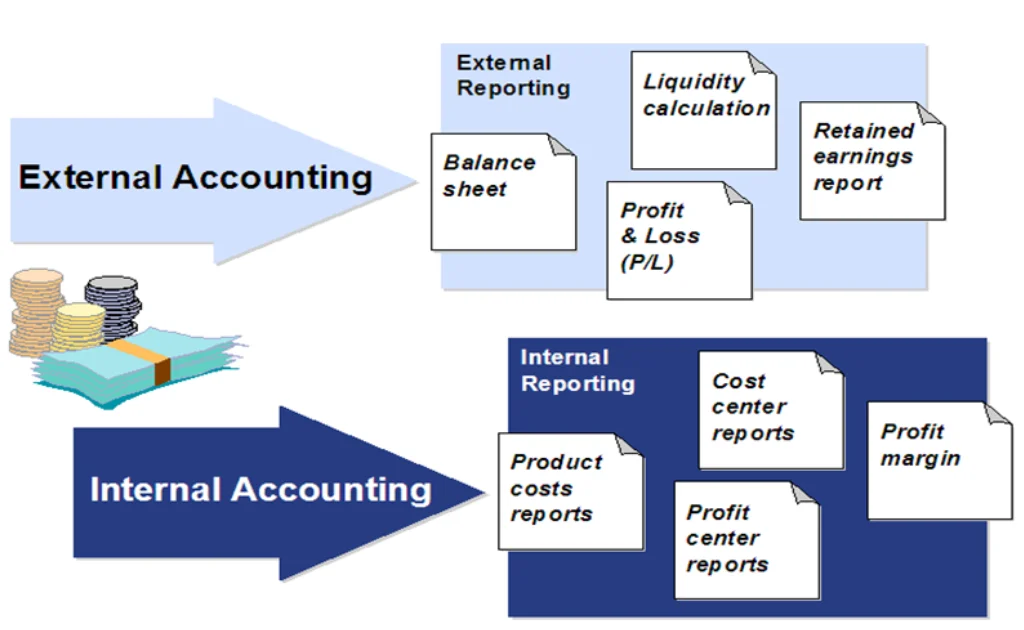

- Financial Reporting:

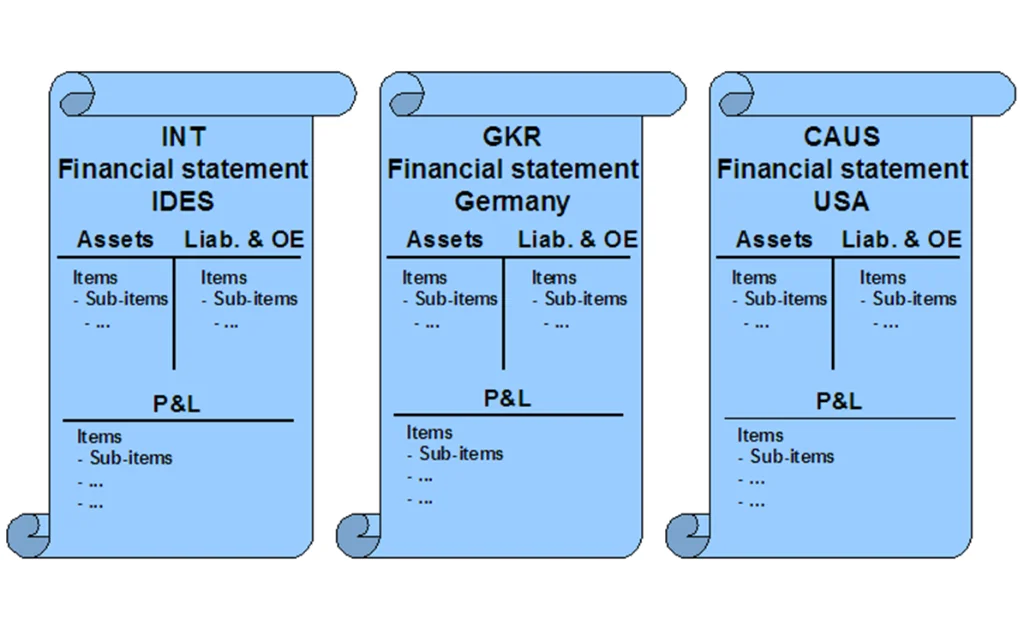

- Generates legal financial statements like Balance Sheets and Profit & Loss (P&L).

- Integration:

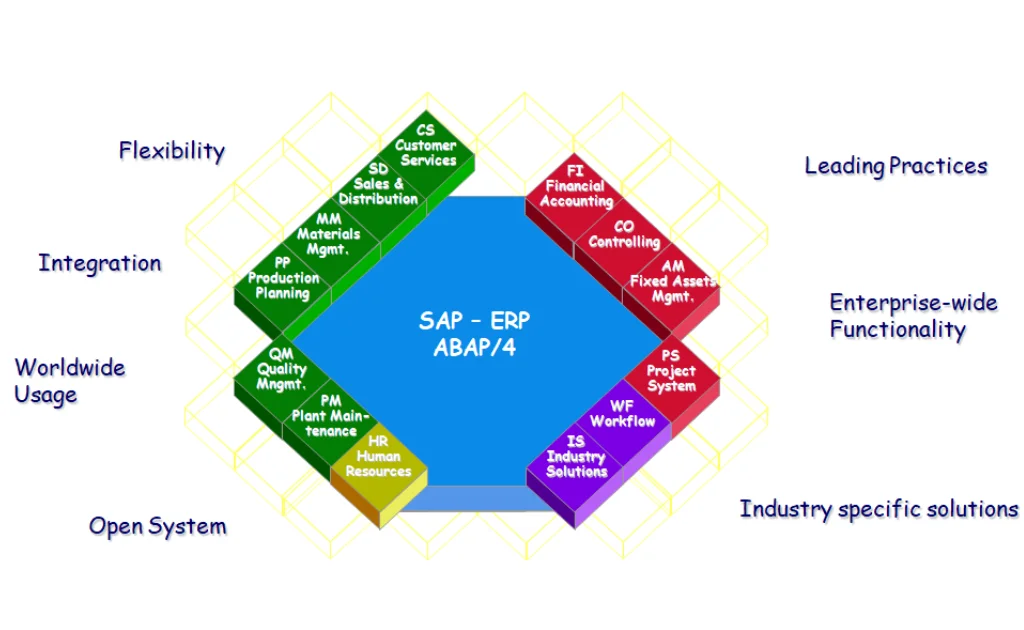

- Seamlessly integrates with other SAP modules like MM (Material Management), SD (Sales & Distribution), and CO (Controlling) for smooth operations and real-time updates.

Why SAP FI is Important:

- Ensures legal compliance and audit readiness

- Provides accurate financial reporting for stakeholders

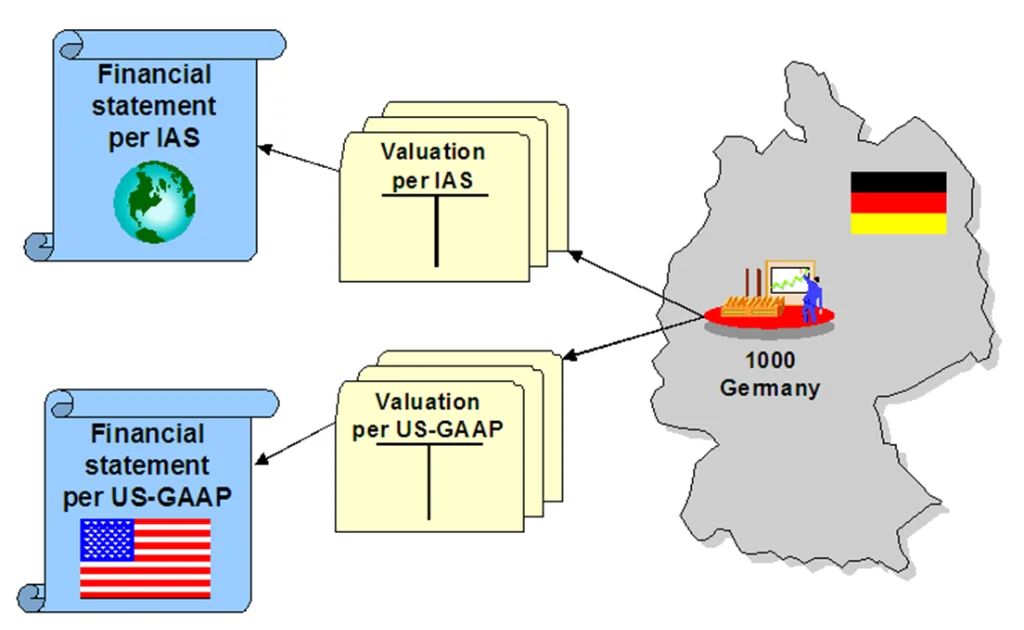

- Enables global operations with support for multiple currencies and country-specific rules

- Helps in decision-making through real-time financial insights

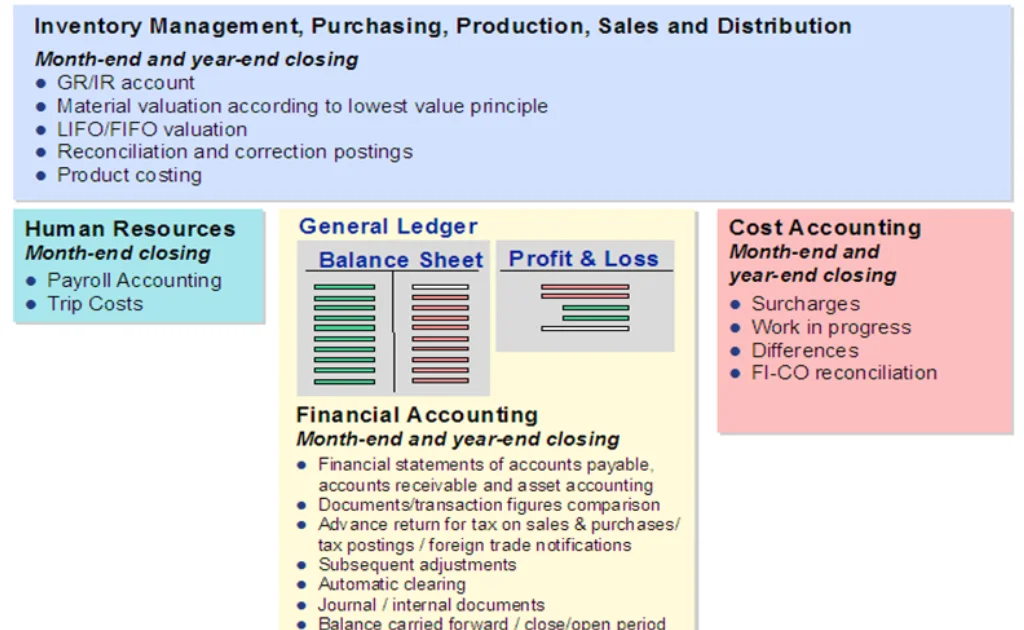

SAP ERP Core Componants